Understanding the Importance of Positive Cash Flow

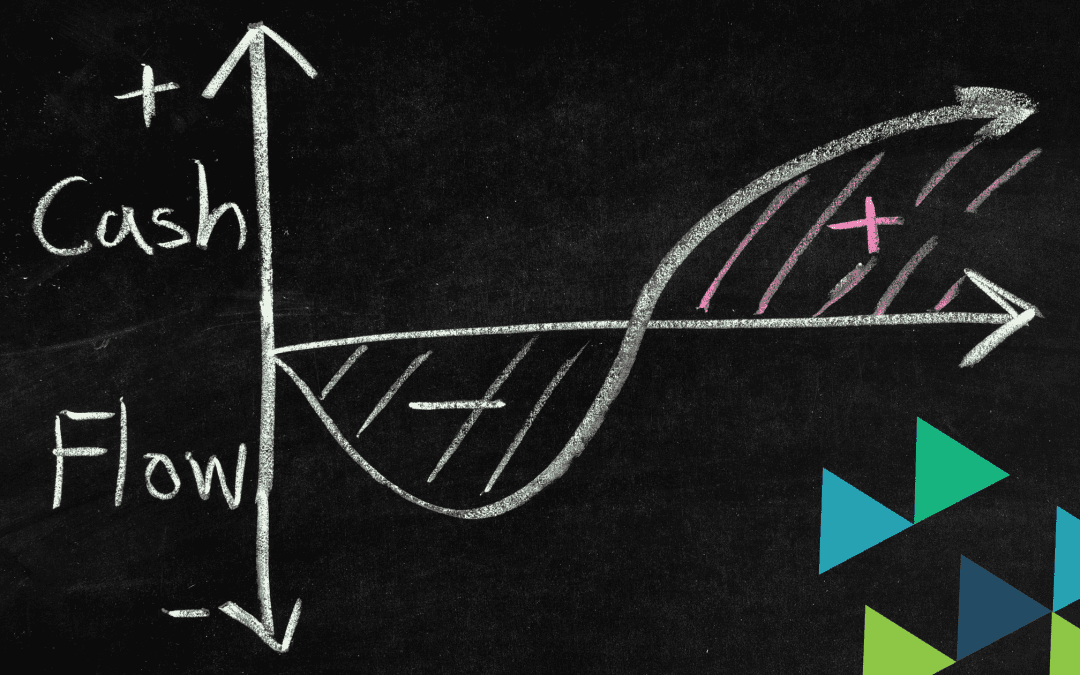

As a small to medium business owner, it’s crucial to understand the significance of Key Performance Indicators (KPIs) and the pivotal role of positive cash flow in driving business growth. KPIs are essential metrics that help businesses track and measure their performance in various areas. Among these KPIs, one stands out as the “King KPI” – positive cash flow. Positive cash flow is the lifeblood of any business, representing the difference between the cash coming into the business and the cash going out. The equation for net cash flow is simple yet powerful: Net cash flow = cash flow in – cash flow out.

What are Negative and Positive Cash Flow Items?

In the context of cash flow, it’s essential to distinguish between negative and positive cash flow items. Negative cash flow items represent cash outflows that exceed cash inflows, leading to a net reduction in cash reserves. These may include expenses such as loan repayments, equipment purchases, and operational losses. On the other hand, positive cash flow items contribute to an increase in cash reserves, encompassing sources of income like sales revenue, investments, and financing activities that bring in more cash than they consume.

The Importance of Positive Cash Flow

Positive cash flow is vital for sustaining and expanding a business. It provides the financial stability necessary to cover operational expenses, invest in growth opportunities, and weather unexpected challenges. Here are some key reasons why positive cash flow is crucial for business growth:

- Operational Stability: Positive cash flow ensures that a business can meet its day-to-day financial obligations, such as paying suppliers, employees, and utility bills.

- Investment and Expansion: With positive cash flow, businesses have the resources to invest in new equipment, technology, marketing efforts, and expansion initiatives, fostering growth and competitiveness.

- Resilience: A healthy cash flow position acts as a buffer against economic downturns, market fluctuations, and unforeseen expenses, enabling businesses to navigate challenging times without compromising their operations.

How Does Positive Cash Flow Impact Business Growth?

Positive cash flow plays a pivotal role in driving business growth by providing the financial stability necessary to cover operational expenses, invest in growth opportunities, and navigate unexpected challenges. Here’s how positive cash flow impacts business growth:

- Operational Stability: Positive cash flow ensures that a business can meet its day-to-day financial obligations, such as paying suppliers, employees, and utility bills.

- Investment and Expansion: With positive cash flow, businesses have the resources to invest in new equipment, technology, marketing efforts, and expansion initiatives, fostering growth and competitiveness 1.

- Resilience: A healthy cash flow position acts as a buffer against economic downturns, market fluctuations, and unforeseen expenses, enabling businesses to navigate challenging times without compromising their operations.

How Does Cash Flow Affect Investment Decisions?

Cash flow significantly influences investment decisions by providing crucial insights into a company’s financial health and its ability to fund growth and expansion. Here’s how cash flow affects investment decisions:

- Free Cash Flow (FCF): FCF represents the money a company has left over to expand the business or return to shareholders after paying dividends, buying back stock, or paying off debt. It is a key metric used by investors to assess a company’s financial performance and its capacity for future investments 1.

- Unlevered Free Cash Flow (UFCF): UFCF measures the gross FCF generated by a firm that excludes interest payments, showing how much cash is available to the firm before financial obligations. This metric helps investors gauge the potential for further investments and growth initiatives 1.

- Operating Cash Flow (OCF): OCF, which represents money generated by a company’s primary business operation, is essential for evaluating a company’s ability to generate cash from its core activities, which is crucial for funding future investments 2.

- Cash Flow from Investing Activities: This section of the cash flow statement provides insights into how much cash has been used in or generated from making investments during a specific period. It includes purchases of long-term assets, acquisitions of other businesses, and investments in marketable securities. Understanding this cash flow component is vital for assessing a company’s investment decisions and long-term growth strategies 3.

- Cash Flow from Financing Activities: This section measures the flow of cash between a firm and its owners and creditors, providing information on how often and in what amounts a company raises capital from debt and equity sources. It also reveals how a company pays off these items over time, influencing investment decisions by indicating the company’s capital structure and financial stability 4.

Seek Expert Assistance with Your Business KPIs

Understanding and effectively managing KPIs, especially positive cash flow, is critical for the success of any business. If you need guidance in optimizing your business’s KPIs and ensuring a healthy cash flow, consider reaching out to TSP Accountants & Business Advisors. Their expertise and tailored solutions can help you navigate the complexities of financial management and drive your business towards sustainable growth.

Making positive cash flow the King KPI is fundamental for the prosperity and longevity of your business. By leveraging this understanding and seeking professional support, you can position your business for sustained success and resilience in the ever-evolving marketplace.

Reach out to the TSP Accountants & Business Advisors team for assistance today. Email: ad***@****************om.au or phone us on 49 26 4155 or send us a message through our Contact Us page

- Coalition’s Budget Response - 10/04/2025

- Final Call On $20k Instant Asset Write Off - 04/04/2025

- 25/26 Federal Budget Insights - 26/03/2025